|

|

| |

| |

Rep. Loudermilk: Rebuilding our Military |

|

|

|

| |

| |

A Message from Rep. Loudermilk: Business is Booming |

|

| |

| |

Press Release of the Week: Rep. Loudermilk Receives Guardian of Small Business Award

|

|

| |

Rep. Loudermilk (R-GA) issued the following statement after he was awarded NFIB’s (National Federation of Independent Business) Guardian of Small Business Award:

“The American economy is fueled by our small businesses, which is why House Republicans have been committed to passing reforms that benefit Main Street, not Wall Street. I was a small business owner for over twenty years, and remember the times when I worried about rising taxes, bureaucratic red tape, and increased healthcare costs; and viewed those in Washington, D.C. as the problem, not the solution. That’s why I support commonsense legislation that aims to get elected bureaucrats out of the way so our small businesses can thrive.”

Read More ▸

|

|

| |

| |

In the News: House Republicans press Fed to deregulate large banks |

|

| |

From Politico Pro:

House Republicans press Fed to deregulate large banks

By: Zachary Warmbrodt

House Republicans are stepping up pressure on the Federal Reserve to take full advantage of May's landmark bank-deregulation bill, warning that they are uneasy with signals the central bank is sending.

Echoing the angst in the banking industry, 29 Republicans in a letter to Fed Vice Chairman for Supervision Randal Quarles said regulators should take "quick action" to completely remove several domestic and international firms from rules intended to tamp down on systemic risk.

At issue are banks with between $100 billion and $250 billion in assets, which the new law directed the Fed to revisit for lighter-touch regulation.

"[w]e still have concerns with the Fed's posture on this issue going forward as we are unsure if the Fed is committed to fully removing these firms from regulation as a systemically important financial institution (SIFI) if they do not pose a systemic risk to the economy," they wrote.

Rep. Barry Loudermilk (R-Ga.) led the letter. It has signatures from senior Financial Services Committee Republicans as well as Rep. Tom Graves (R-Ga.), the chairman of the financial services appropriations subcommittee. SunTrust, based in Georgia, is one of the banks that could benefit from the upcoming rule changes.

"[w]e are concerned that you have expressed the intention to further review these firms in order to determine how to regulate them," the lawmakers said. "Due to the fact that there have been no past nor any present findings of systemic risk, we strongly believe that the Fed should take quick action to completely remove these firms, both domestic and international, from all SIFI-associated regulations."

|

|

|

|

| |

| |

Social of the Week: Georgia Named Top State for Business |

|

|

|

| |

| |

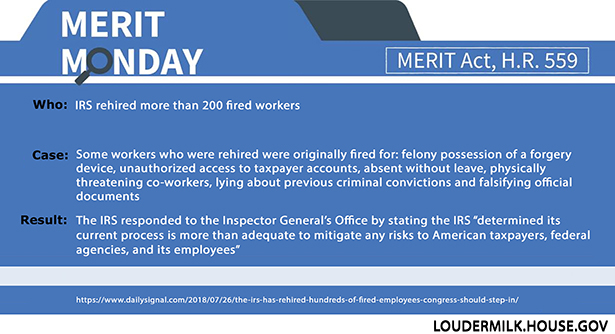

Graphic of the Week: The MERIT Act |

|

|

|